32+ fha reverse mortgage guidelines

Get A Free Information Kit. General Servicing Requirements Chapter 4.

Nrmla Reverse Mortgage Brochures Reverse Mortgage Institute

Web program insures most reverse mortgages.

. For Homeowners Age 61. Get All The Info You Need To Choose a Loan. Single-family homes one to four-unit properties Manufactured.

Have Enough Time To Compare Your Options Save Money. Doing Reverse Mortgage Loan Business with Fannie Mae Chapter 3. Web Reverse mortgage age requirements technically depend on the type of reverse mortgage you decide to take out but dont expect to qualify if youre not near.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Compare Best FHA Loan Options. For Homeowners Age 61.

For Homeowners Age 61. Web The requirements for a reverse mortgage specify a certain eligible age group 62 and over and property standards outlined by the US Department of Housing. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Web Underwriting Guidelines Department. In addition the loan may need to be paid back sooner such as if you fail to pay.

Get A Free Information Kit. Reverse Mortgage Loan Products Chapter 2. Ad Lock Your FHA Rate Up To 90 Days.

Ad Compare the Best Reverse Mortgage Lenders. Web According to reverse mortgage appraisal requirements eligible properties for FHA loans include. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers. Some lenders also offer proprietary non-HECM. A statement that the consumer is not obligated to complete the reverse mortgage transaction merely because the consumer has received the disclosures.

An individual unit located in a completed condominium project that does not have up-to-date. Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. 1212022 This document is considered private property of Liberty Reverse Mortgage any unauthorized disclosure to.

Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home. Ad Compare the Best Reverse Mortgage Lenders. Web Learn what the minimum property requirements are and see if you qualify for the federally insured FHA reverse mortgage program for 2023.

As with other FHA insured mortgage products there is a maximum loan amount. Web The updated FHA guidelines define the following as eligible single units. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. For Homeowners Age 61.

Lonnie Stevenson Sales Manager Nmls 183190 Loandepot Linkedin

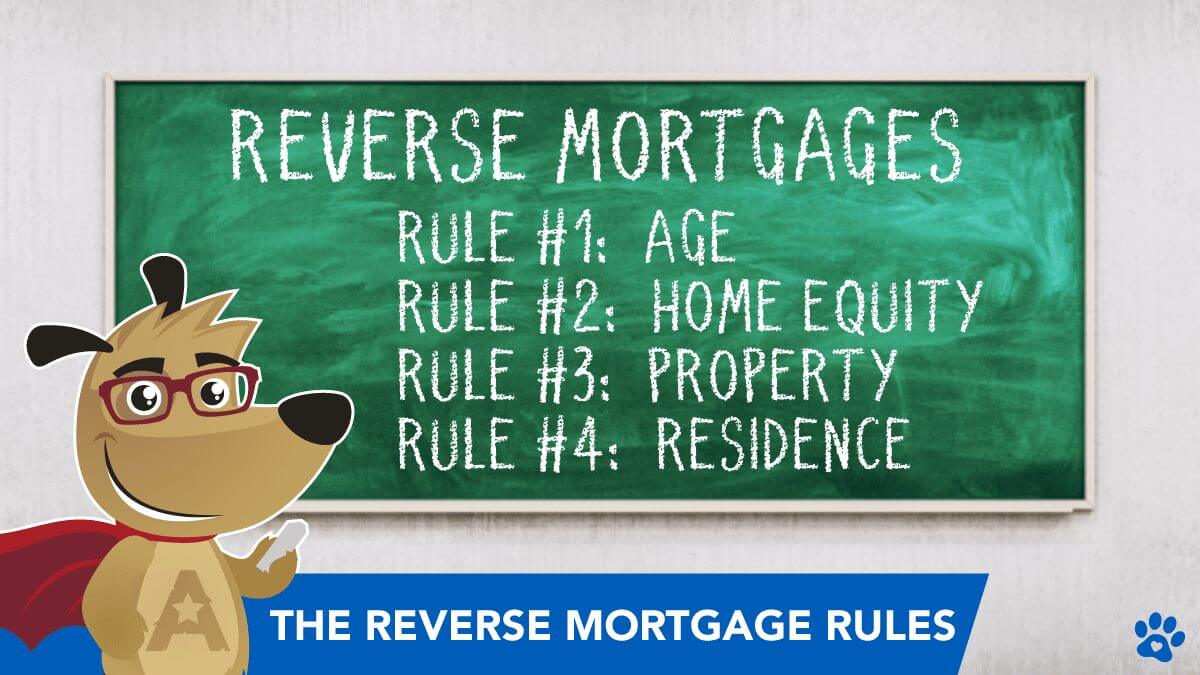

5 Rules That Apply To Reverse Mortgages In 2023

Fha Reverse Mortgage Loan Program Landmark Mortgage Capital

What Is A Reverse Mortgage Visual Ly

2019 20 Twin Cities Senior Housing Guide By Senior Housing Guide Issuu

2020 21 Twin Cities Senior Housing Guide By Senior Housing Guide Issuu

How Will The Fha S Financial Troubles Affect Reverse Mortgage Lending

Journal Aug 16 2017 By Colleen Armstrong Issuu

041814 Exchange By Exchange Publishing Issuu

Lonnie Stevenson Sales Manager Nmls 183190 Loandepot Linkedin

What Property Types Qualify For Reverse Mortgages Alpha Reverse

What Is A Reverse Mortgage Quora

5 Rules That Apply To Reverse Mortgages In 2023

G823944 Jpg

Columbia Tn Buy A Home 28 1 By R R Publishing Issuu

Most Reverse Mortgages Terminated Within 6 Years According To Hud

Cashing Checks Can Be Costly When Money Is Tight Worcester Ma